Georgia Bankruptcy Records

Georgia bankruptcy records are held by three federal courts that cover all 159 counties in the state. The Northern District in Atlanta handles cases for the metro area and north Georgia. The Middle District in Macon serves central and southwest Georgia, while the Southern District covers the coast and southeast from Savannah, Augusta, and Brunswick. You can search Georgia bankruptcy records online through PACER, by phone for free using McVCIS, or in person at any staffed clerk's office. All bankruptcy filings in Georgia are public and open to anyone who wants to look them up.

Georgia Bankruptcy Records Quick Facts

Georgia Federal Bankruptcy Courts

Georgia has three federal bankruptcy court districts. Each one handles cases for a set group of counties. You need to search the right district to find a case. The county where the debtor lived at the time of filing decides which court holds the records. All three Georgia courts are part of the federal judiciary and follow the same rules for public access to bankruptcy records.

The Northern District of Georgia Bankruptcy Court has its main office in Atlanta at the Richard B. Russell Federal Building, 75 Ted Turner Drive SW, Room 1340. This court handles bankruptcy records for 46 counties in metro Atlanta and north Georgia. Chief Judge Barbara Ellis-Monro leads the court. Vania S. Allen serves as clerk of court. Call (404) 215-1000 for help with bankruptcy records in the Northern District. The court also runs divisional offices in Gainesville, Newnan, and Rome for cases filed in those parts of the state.

The Northern District website has case lookup tools and filing guides for Georgia bankruptcy records in the Atlanta division.

The Middle District of Georgia Bankruptcy Court is in Macon at the Thomas Jefferson Federal Building, 433 Cherry Street. It serves 69 counties across central and southwest Georgia. Chief Judge Austin E. Carter runs this court and Kyle George manages the clerk's office. Staffed offices are in Macon and Columbus. The court holds hearings in Albany, Athens, Thomasville, and Valdosta too, but those offices are only open on hearing days. Call 478-752-3506 for the Macon office or 706-649-7837 for Columbus.

The Middle District site lists Georgia court locations, office hours, and details on how to access bankruptcy records in central Georgia.

The Southern District of Georgia Bankruptcy Court covers 43 counties along the coast and in southeast Georgia. It has staffed offices in Augusta, Brunswick, and Savannah. Chief Judge Michele J. Kim leads the court. Dana M. Wilson is the clerk. Offices in Dublin, Statesboro, and Waycross hold hearings but are not always staffed. Mail for those should go to the Augusta or Brunswick office. The Augusta mailing address is PO Box 1487, Augusta, GA 30903. The Savannah office is at 124 Barnard Street, Second Floor, Savannah, GA 31401.

The Southern District website has contact details and case access information for bankruptcy records at each of its Georgia offices.

How to Search Bankruptcy Records in Georgia

PACER is the main tool for finding bankruptcy records in Georgia. It stands for Public Access to Court Electronic Records. You can use it from any computer at any time. The system is online around the clock, all year long. It covers all three Georgia federal districts in one place.

The PACER website lets you search by name or case number. You make a free account first. After you log in, you can view docket sheets, pull up court papers, and check case status for any bankruptcy filing in Georgia. The cost is $0.10 per page for searches and document downloads. PACER is provided by the federal judiciary to give the public electronic access to case and docket information from federal appellate, district, and bankruptcy courts across the country.

PACER is the primary database for all federal bankruptcy records in Georgia and the rest of the United States.

If you do not know which Georgia court handled a case, use the PACER Case Locator. This tool searches all federal courts at once. You can find any Georgia bankruptcy case without knowing the specific district. It lets you narrow results by state, date range, or chapter type. You can also save links to cases you check often and store frequent searches for later use.

The Case Locator pulls results from all three Georgia bankruptcy court districts in one search.

McVCIS is a free phone service for basic Georgia bankruptcy case details. Call 1-866-222-8029 from any touch tone phone. The system runs day and night, all year. It gives you general case information over the phone at no charge. McVCIS can tell you:

- Debtor name and case number

- Assigned judge and filing date

- Chapter filed (7, 11, 12, or 13)

- Asset or no-asset status

- Attorney and trustee names

- Current case status

You can also go to any staffed clerk's office in Georgia. Public computer terminals are free to use there. You can view dockets and case documents at no cost. Printing costs $0.10 per page from these terminals.

Note: McVCIS provides general Georgia bankruptcy case information only and is not the official court record.

Georgia Bankruptcy Case Information

Each district court in Georgia has its own case information resources online. These pages explain the ways to access bankruptcy records and what tools are on hand for the public.

The Northern District case information page covers record access for cases filed in the Atlanta area and north Georgia counties. PACER is the primary method for online searches in this district. The page also explains how to use public terminals at the Atlanta courthouse.

The Northern District provides electronic access to case and docket information through PACER for all 46 counties it serves in Georgia.

The Southern District case information page explains how to get bankruptcy records from the Savannah, Augusta, and Brunswick offices. PACER is an electronic public access service that provides the public with electronic access to case and docket information from federal bankruptcy courts. This page covers copy fees and provides instructions on ordering records by mail or in person at any of the three staffed Georgia offices.

The Southern District page details fees, phone numbers, and mailing addresses for all Georgia offices in the district.

The Middle District court information page lists the Macon and Columbus staffed offices along with hearing-only locations in Albany, Athens, Thomasville, and Valdosta. Only the Macon and Columbus divisional offices are regularly staffed. The other offices are open only when hearings are held at those Georgia locations.

The Middle District notes that only its Macon and Columbus offices in Georgia have full-time staff for bankruptcy records requests.

Georgia Bankruptcy Record Fees

Fees for getting bankruptcy records in Georgia follow the standard federal schedule. PACER charges $0.10 per page for searches and downloads. This rate is the same at all three Georgia districts. It applies whether you search from home or use a public terminal at the courthouse.

At any Georgia clerk's office, viewing records on public computer terminals is free. Printing from those terminals costs $0.10 per page. Copies you request in person or by mail cost $0.50 per page. Certified copies add $12.00 per document on top of the copy fee. If you need the court to search for a case and do not have a case number, the fee is $34.00. Payment is by money order or certified check made out to "Clerk, U.S. Bankruptcy Court." Some Georgia offices take cash for walk-in requests.

You can file a Form B1320 (Application for Search of Bankruptcy Records) to request a name search when the case number is not known. The form is free to download. The $34.00 fee covers the court's time to search its records for matching Georgia bankruptcy cases.

Form B1320 is the standard federal form used to request a search of bankruptcy records when you do not have a case number for a Georgia filing.

Types of Bankruptcy in Georgia

Georgia residents can file under four main chapters of the federal Bankruptcy Code, Title 11 U.S.C. Each chapter serves a different purpose and creates different types of records in the Georgia court system.

Chapter 7 is a liquidation case. A trustee sells the debtor's non-exempt assets to pay creditors. This is the most common type of bankruptcy filed in Georgia. Chapter 7 cases move fast. Most close in a few months. The records include the petition, schedules of assets and debts, and the discharge order. Chapter 13 lets people with steady income set up a repayment plan that runs three to five years. Records for these Georgia cases include the plan, payment history, and any changes made along the way.

Chapter 11 is for business reorganization. People with large debts sometimes use it too. These Georgia cases can be complex and produce thick case files with many filings. Chapter 12 covers family farmers and fishermen. It is rare in Georgia but still an option for those who qualify.

The Federal Rules of Bankruptcy Procedure govern every case filed in Georgia. These rules set the steps and deadlines that courts, debtors, and creditors must follow throughout the bankruptcy process.

Georgia Bankruptcy Exemptions

Georgia has opted out of federal bankruptcy exemptions. People who file in Georgia must use the state exemption list under O.C.G.A. § 44-13-100. These exemptions set what property a debtor can keep safe from creditors in a Georgia bankruptcy case.

The homestead exemption covers up to $21,500 in equity in your home. Married couples filing together may protect up to $43,000 if the home is in one spouse's name. A motor vehicle is exempt up to $5,000. Personal property items worth $300 or less each can be kept up to $5,000 total. Tools of the trade are exempt up to $1,500. Jewelry gets a $500 limit. A wildcard exemption of $1,200 is available, and you can add up to $10,000 of unused homestead exemption to it. These Georgia exemptions apply in all three federal court districts.

Some assets are fully exempt with no dollar cap in Georgia. Workers' compensation benefits are protected under O.C.G.A. § 34-9-84 and cannot be touched by creditors. Social Security payments, unemployment compensation, veterans benefits, alimony, child support, and crime victims' compensation are all fully exempt. Most retirement accounts like 401(k) plans, 403(b) plans, IRAs, and pensions are also protected in a Georgia bankruptcy case.

The Georgia Superior Court Clerks' Cooperative Authority (GSCCCA) connects the public to county clerk offices across the state. County clerks do not hold bankruptcy files, but they keep property records, deeds, and liens that often come up during Georgia bankruptcy cases.

The GSCCCA website provides a directory of all 159 county clerk offices and their available records in Georgia.

The Georgia Courts website has more details on the GSCCCA and its role in the state court system. It explains how county clerks support public access to court records across Georgia.

Georgia Courts outlines how the GSCCCA helps the public find county-level records that may relate to bankruptcy cases.

County Clerks and Bankruptcy in Georgia

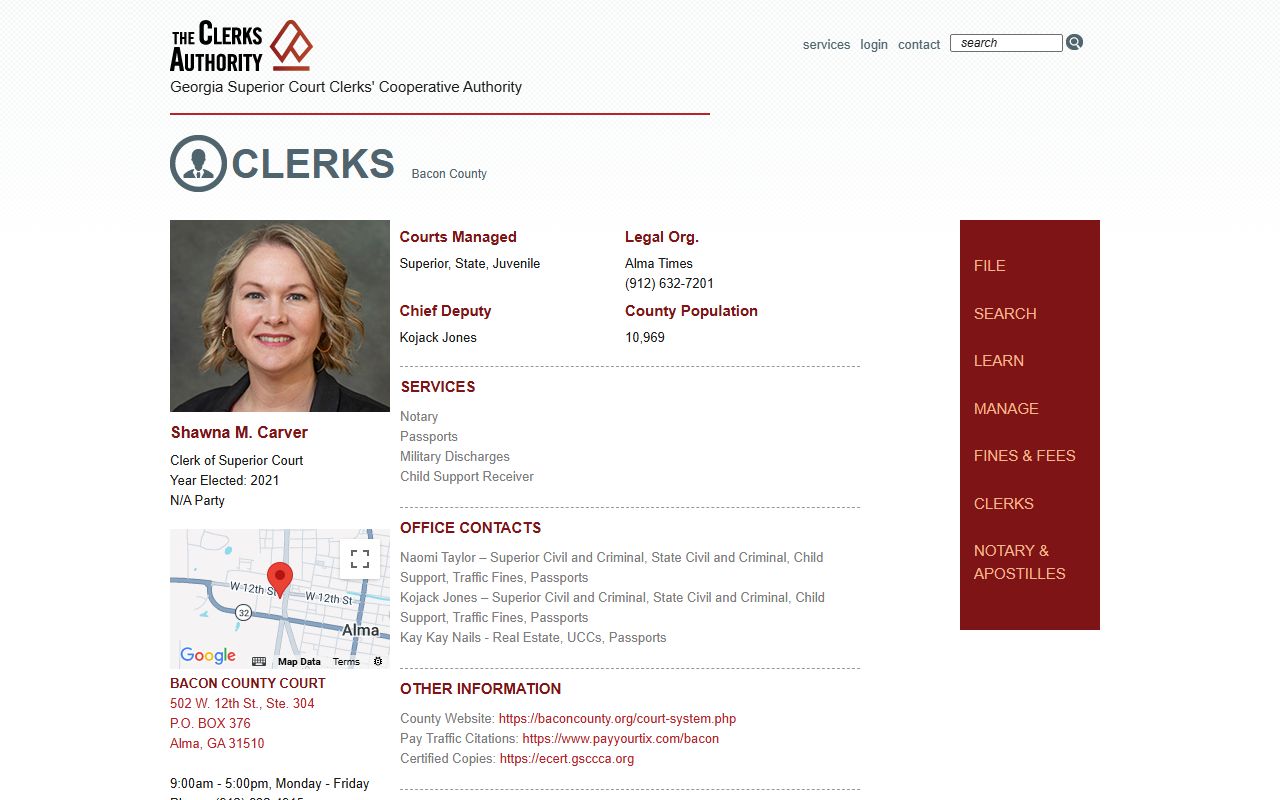

County Superior Court clerks in Georgia do not manage bankruptcy records. Bankruptcy is strictly federal. But county clerks keep state court files that can connect to a bankruptcy case. These include civil lawsuits, property deeds, liens, judgments, and other documents filed at the county level in Georgia.

The GSCCCA clerk directory helps you find the right county clerk office. All 159 Georgia counties have their own clerk of Superior Court who handles state-level records. If a Georgia bankruptcy case involves real property, the county clerk may have deed records or lien filings that connect to the case. You can search these state records separately from the federal bankruptcy file.

The GSCCCA provides a lookup tool for county clerk contact details across all Georgia counties.

Archived Georgia Bankruptcy Records

Closed bankruptcy cases in Georgia are eventually sent to the National Archives and Records Administration (NARA) for long-term storage. After a case has been closed for several years, the federal court transfers the files to NARA. This applies to older Georgia bankruptcy cases from all three districts.

NARA stores archived federal court records including older Georgia bankruptcy case files from the Northern, Middle, and Southern Districts.

To order records from NARA, you need the case number, accession number, location number, and box number. Contact the Georgia bankruptcy court clerk's office first. The clerk can confirm if a case has been sent to NARA and give you the reference numbers you need to place your order. Without these numbers, NARA cannot locate the file.

Note: Always contact the Georgia bankruptcy court clerk before placing a NARA order so you have the correct reference numbers for your case.

Georgia Bankruptcy Filing Rules

Georgia has rules that affect who can file and how often. To use Georgia's state exemptions, you must have lived here for at least 730 days before filing. That is two full years. If you moved to Georgia from another state, you may need to use your old state's exemptions instead. This residency rule applies at all three Georgia bankruptcy court districts.

Time limits also control how often you can file for bankruptcy in Georgia. You must wait eight years between Chapter 7 cases. Going from Chapter 7 to Chapter 13 takes a four-year gap. Between two Chapter 13 filings, the wait is two years. The Georgia bankruptcy courts check these limits when any new case is filed. If you file too soon, the court may dismiss your case or deny your discharge.

Browse Georgia Bankruptcy Records by County

Each of Georgia's 159 counties is assigned to one of three federal bankruptcy court districts. Pick a county below to find court details and local resources for bankruptcy records in that area.

Bankruptcy Records in Major Georgia Cities

Residents of major Georgia cities file bankruptcy cases through the federal court serving their county. Pick a city below to learn about bankruptcy records in that area.