Find Jenkins County Bankruptcy Records

Searching for Jenkins County bankruptcy records starts with the federal court system, not the local courthouse in Millen. All bankruptcy cases in Georgia fall under federal jurisdiction, and Jenkins County belongs to the Southern District. The clerk office in Millen handles state court matters like civil suits and property filings, but bankruptcy is a different story. Whether you need to pull case documents, check a filing status, or verify a discharge, this page shows you how to search Jenkins County bankruptcy records through the proper channels and what each method costs.

Jenkins County Quick Facts

Jenkins County Federal Bankruptcy Court

The Southern District of Georgia Bankruptcy Court processes all bankruptcy filings from Jenkins County. The district has three staffed offices. Savannah is at 124 Barnard Street, Second Floor, Savannah, GA 31401, reachable at (912) 650-4100. Augusta operates from the Federal Justice Center at 600 James Brown Blvd, Augusta, GA 30901, with a phone number of (706) 823-6000. Brunswick is at 801 Gloucester Street, Third Floor.

The Statesboro hearing location at 52 North Main Street, Statesboro, GA 30458, is the closest to Jenkins County. However, this office is not always staffed. Hearings are held there on a scheduled basis only. For filing documents or picking up copies, Jenkins County residents should use the Savannah or Augusta offices. Dana M. Wilson serves as Clerk of Court, and Chief Judge Michele J. Kim leads the district.

Note: Mail all correspondence to the Augusta or Savannah office, not to unstaffed locations.

Searching Jenkins County Bankruptcy Records Online

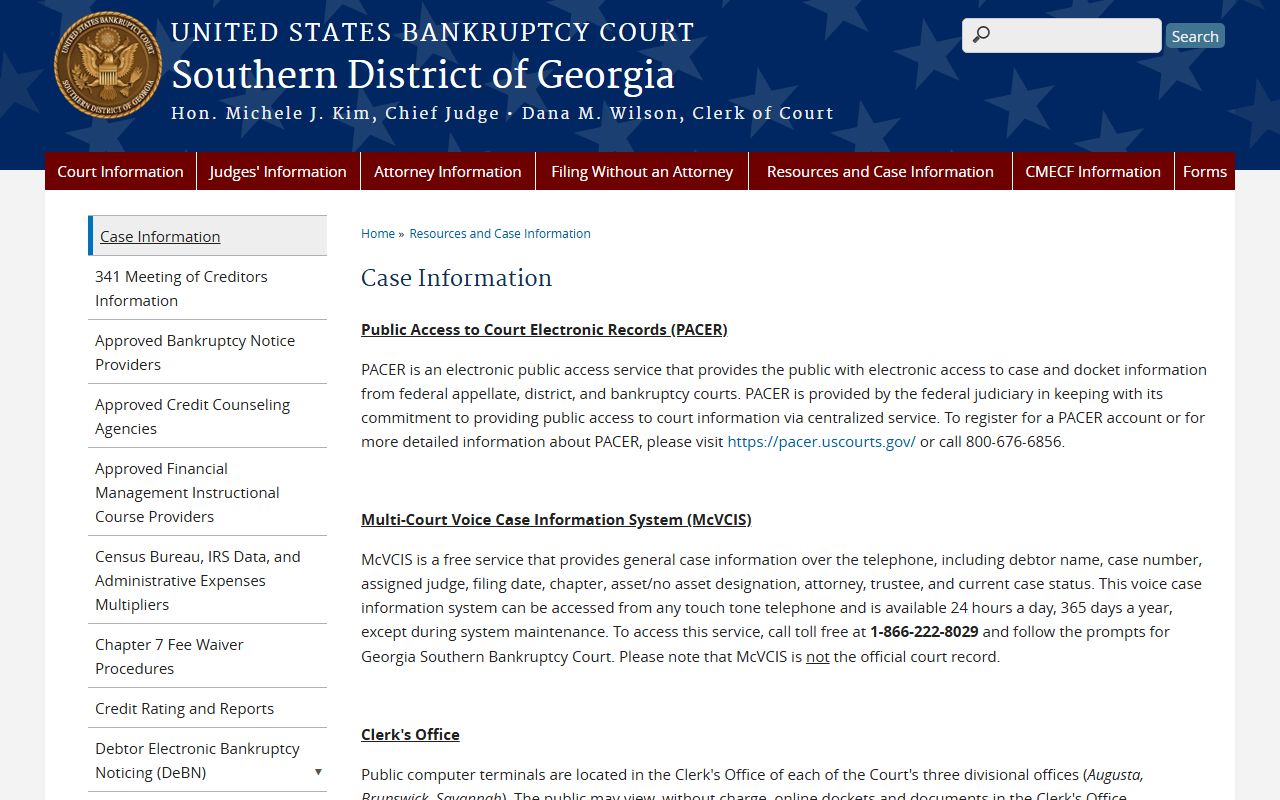

The primary tool for finding Jenkins County bankruptcy records is PACER. Registration is free. Once logged in, you can search the Southern District by debtor name or case number. Every document filed in a Jenkins County case shows up here, from the initial petition to the final discharge. PACER runs 24 hours a day and charges $0.10 per page for views and downloads.

When you do not know the district, use the PACER Case Locator. This tool scans every federal bankruptcy court in the country at once. Enter a name and see all matching results regardless of where the case was filed. You can bookmark cases and save searches you run often.

A free phone option also exists. Call McVCIS at 1-866-222-8029 to get basic case details like the debtor name, case number, judge, filing date, chapter, and status. Select the Southern District from the prompts. This system runs all day, every day. It does not show documents, but it confirms whether a bankruptcy case was filed by someone in Jenkins County.

Fees for Jenkins County Bankruptcy Records

Costs for accessing Jenkins County bankruptcy records depend on how you request them. PACER is $0.10 per page online. Public terminals at the clerk office let you view records free, but printing from them costs $0.10 per page. Copies ordered in person or by mail run $0.50 per page. Certified copies add $12.00 per document.

If you need the court to search for a case and you lack a case number, the fee is $34.00. Fill out Form B1320 and send it with payment. Checks should be made payable to "Clerk, U.S. Bankruptcy Court." Money orders and certified checks work too. Cash is accepted at the counter only. These fee amounts apply across all Southern District offices for Jenkins County records.

Types of Bankruptcy Cases in Jenkins County

Jenkins County bankruptcy filings fall under the federal Bankruptcy Code, Title 11 of the U.S. Code. Chapter 7 cases involve liquidation. A trustee sells off non-exempt assets to pay creditors. This option works for people with low income who cannot sustain a repayment plan. Many Chapter 7 cases from Jenkins County wrap up in just a few months.

Chapter 13 is a wage earner plan. The debtor proposes a repayment schedule lasting three to five years. A court-approved trustee collects monthly payments and distributes them to creditors. This route lets people keep homes and cars while catching up on what they owe. Chapter 11 is mostly for businesses that want to keep operating while they restructure debts. Chapter 12 covers family farmers and fishermen, which can be relevant in a rural county like Jenkins.

Georgia Exemptions in Jenkins County Filings

Georgia opted out of the federal exemption list. Jenkins County filers must use the state exemptions in O.C.G.A. 44-13-100. Here are the key protections:

- Homestead: up to $21,500 in equity

- Vehicle: up to $5,000

- Tools of trade: up to $1,500

- Jewelry: up to $500

- Wildcard: $1,200 plus up to $10,000 unused homestead

Certain income sources are fully exempt. Social Security, workers' compensation under O.C.G.A. 34-9-84, veterans' benefits, unemployment pay, and retirement accounts all have no dollar cap. Alimony and child support payments are protected too. To use Georgia exemptions, a filer must have lived in the state at least 730 days before filing. Re-filing limits also apply. After a Chapter 7 discharge, you must wait eight years for another Chapter 7 and four years for a Chapter 13. Between two Chapter 13 filings, the gap is two years.

Jenkins County Clerk and State Records

The Jenkins County Superior Court Clerk in Millen does not store bankruptcy records. That office manages state court filings: civil cases, criminal cases, deeds, liens, and property records. These records can connect to bankruptcy cases, though. A judgment lien recorded in Jenkins County might appear as a creditor claim in a bankruptcy filing. After discharge, the lien may still show in county records until formally released.

The Georgia Superior Court Clerks' Cooperative Authority offers statewide access to deed and lien records. Comparing GSCCCA data with federal bankruptcy filings helps build a complete view of a debtor's situation in Jenkins County. This matters most in cases that involve real estate or large secured debts.

Archived Cases from Jenkins County

Closed bankruptcy cases eventually leave PACER. The Southern District sends them to the National Archives and Records Administration. To get an archived Jenkins County bankruptcy record, start by calling the clerk at (912) 650-4100. Ask for the accession number, location number, and box number. Then order your copies through NARA's website.

This takes more time than a standard PACER search. Plan ahead if your deadline is tight.

Nearby Counties

Several counties border Jenkins County in southeast Georgia. All of them fall under the Southern District for bankruptcy filings. Confirm the debtor's address at the time of filing to make sure you search the right county.